Search All Homes in the Lake Norman Area

Susie Skog knows Lake Norman Real Estate Inside Out

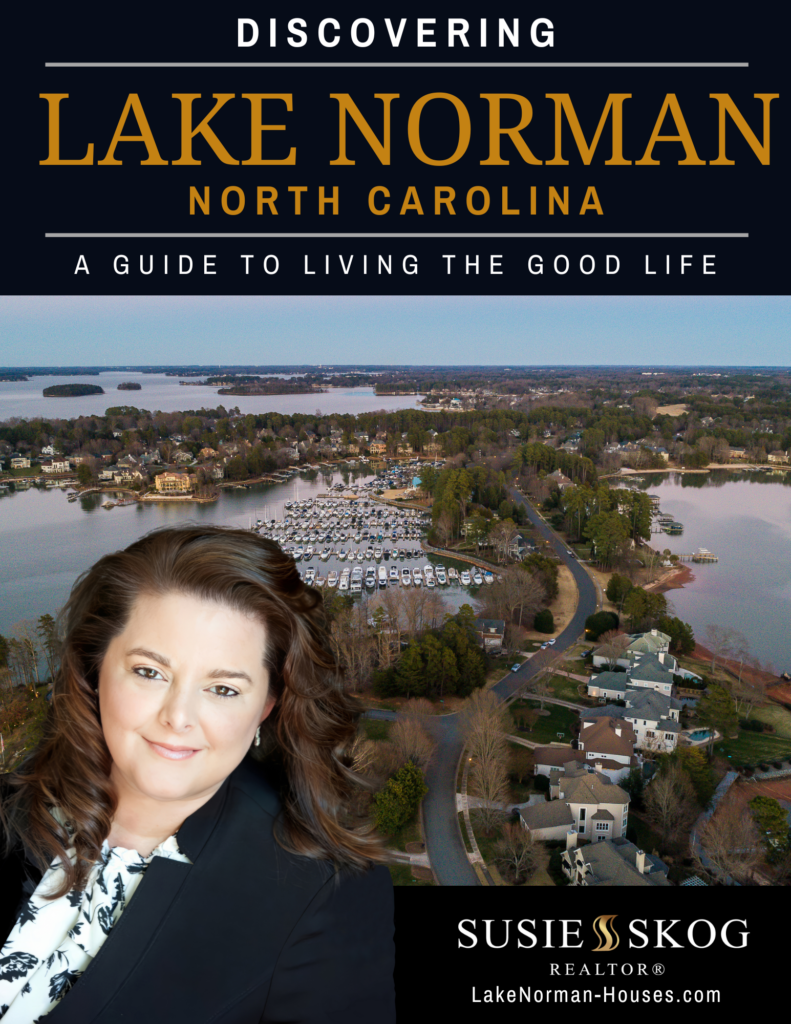

Looking to buy or sell a home in the picturesque Lake Norman area? Meet Susie Skog, your go-to partner for all your real estate needs. With her wealth of experience, unwavering dedication to clients, and impressive track record, Susie is the perfect ally to help you navigate the Lake Norman real estate scene.

Having lived in the Lake Norman area for over 25 years, Susie has extensive hyper-local knowledge. Her representation of a dynamic real estate portfolio requires discretion and specific expertise.

Susie is a real estate professional with Keller Williams. Susie has earned The Institute for Luxury Home Marketing’s Certified Luxury Home Marketing Specialist™ (CLHMS) designation in recognition of experience, knowledge, and expertise in high-end residential properties. Susie has proven performance in buying and selling high-end homes. She has earned an Accredited Buyer’s Representative (ABR®) Designation, Green Designation, Pricing Strategy Advisor (PSA), and Seniors Real Estate Specialist ® (SRES) Designation, and a certified Online Luxury Marketing Specialist. In addition, Susie is a member of the Keller Williams Sports and Entertainment division.

Whether you’re seeking a bustling urban environment or a peaceful lakeside retreat, Susie will guide you to the perfect location that matches your preferences and needs.

Home Valuation

What Is Your Home Worth?

Listing by Email

Get Daily Listing Email Updates

My Account

Login to Save Listings and Searches

I WANT TO SELL

I WANT TO BUY

Want to Discover and Live the Good Life in Lake Norman, North Carolina?

Grab a FREE copy of Susie Skog’s Exclusive Local’s Guide

Latest News

How to Sell a Home That’s Been on the Market Too Long

When your home sits on the market longer than expected, it can feel discouraging. However, you still have options. In fact, many sellers in Lake Norman face the same challenge. Buyers may have overlooked your home, but that doesn’t mean it won’t sell. With the right...

Marketing a Home to Out-of-State Buyers Moving to Lake Norman

Why Out-of-State Buyers Choose Lake Norman Lake Norman draws many people looking for a new lifestyle. Buyers relocating here often want more space, nature, and a slower pace. The area offers welcoming communities and a variety of homes to fit different needs....

Real Estate Home Tips

5 Features for a Luxurious Home This Winter

Here are five of the best luxuries for your home that will get you through this winter.

Radiant Heat

Theres nothing like stepping out of bed and onto a heated floor on a winter morning.

Outdoor Hot Tub

It never feels better to brave the outdoors and have a hot soak in the backyard than in the winter.

Grand Fireplace

Having a home with a grand fireplace in the living room is the perfect centerpiece in the winter.

Steam Room or Sauna

Your own private space for heat therapy will keep your core feeling warm all season long.

Heated Driveway

A heated driveway is a must-have feature in the winter that will save you from shoveling snow and ice.

Published with permission from RISMedia.

A Guide to Natural Stone Flooring

Natural stone is prized for its appealing look and impressive durability. Is it right for your home?

Slate, marble, travertine, limestone or granite – chances are theres an option thats right for your home no matter what your preferred style is.

There are a variety of grades and ratings assigned to natural stone that will help you to determine the most practical option.

Depending on the quality of the stone, these grades can vary, though the most common weakness for different types of natural stone is absorption rating.

If youre planning to use natural stone for your new terrace or patio, keep the absorption rating in mind, because absorbed water can turn to ice and crack the stone.

Published with permission from RISMedia.

Featured Communities

Insights & Trends

How to Design With Art Deco

Published with permission from RISMedia.

5 Ideas to Upgrade Your Basement

Published with permission from RISMedia.

5 Features of A Luxury Kitchen

Published with permission from RISMedia.